Problem debts to government

Serious, growing and poorly understood

More and more people are finding it difficult to pay debts owed to government or utility providers.

In research* published this month the National Audit Office says government has better information about bank debt (including mortgage arrears) than about debt arising from council tax, benefit repayment and utility bills.

The NAO estimates debts from these sources at £18 billion or more.

Citizens Advice national level data** back up this picture. Between 2011-12 and 2017-18, the proportion of reported problems relating to consumer credit fell, while for government debts it rose significantly.

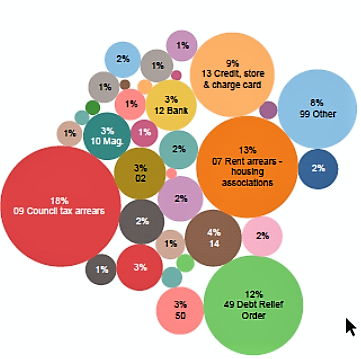

In Reigate & Banstead council tax arrears has been the debt problem most often reported this year (January to August 2018) as the chart shows.

The problem of government debts is made worse by a lack of reliable information. The NAO and Citizens Advice are both calling on government to use its resources to fill this gap. Its policies are an important influence on these debts (for example benefit arrangements) so it needs to take more responsibility for understanding and improving things.

The NAO correctly summarises the concern felt throughout the Citizens Advice network about the consequences of growing personal debt:

Over-indebtedness, or problem debt, is when someone becomes unable to pay their debts or other household bills. Debt problems are detrimental to people’s wellbeing, and can lead to higher use of public services such as mental health services and state-subsidised housing, with resulting costs to the public purse. Over-indebtedness also results in costs to the wider economy, for example through lost productivity or increased crime.

** Tackling problem debt, National Audit Office, September 2018

** Government need to get a grip on scale of household debt, Citizens Advice, 06/09/18